The jobs report on Friday may provide answers to the state of the labor market

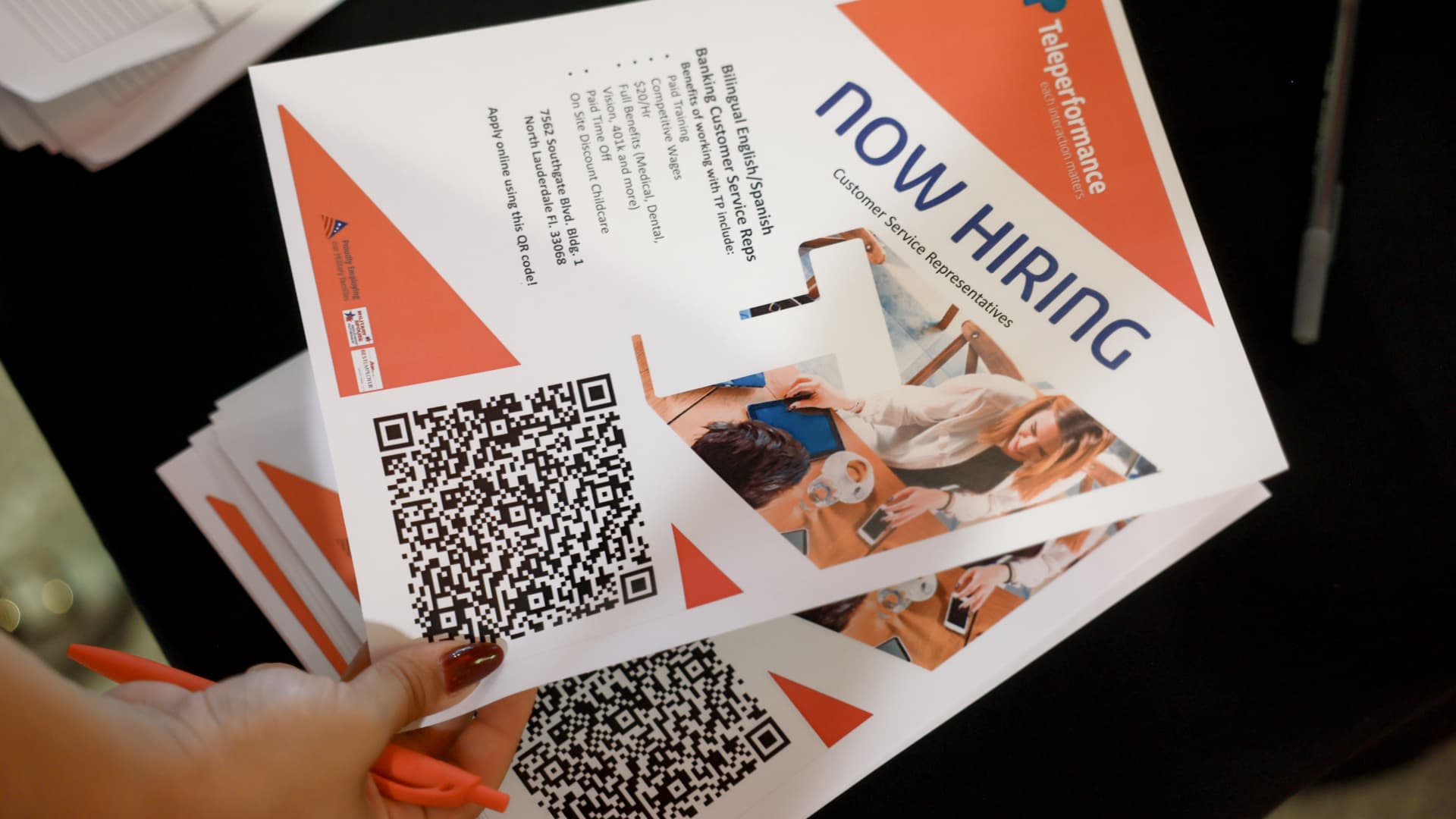

Job seekers attend the JobNewsUSA.com South Florida Job Fair held at Amerant Bank Arena on June 26, 2024 in Sunrise, Florida.

Joe Raedle | Getty Images

With signs that the labor market is at least slowing, if not worse, the June nonfarm payrolls report takes on added significance.

Wage gains so far in 2024 have reached 1.24 million, about 50,000 a month less than the same period a year ago. Economists polled by Dow Jones expect the report, to be released at 8:30 a.m. Friday, to show an increase of 200,000, from the 272,000 reported for May.

In historical terms, the pace of job gains is still solid. But there are signs bubbling down that conditions may soften and perhaps point to broader economic weakness on the way.

“This is a report that is coming at a point where there is a little more uncertainty about the economic landscape than there has been in several months,” said Nick Bunker, head of economic research at Indeed Hiring Lab. Specifically, I’m thinking more about the unemployment rate, which has been slowly rising.

The unemployment rate in May rose to 4%, the first time it has reached that threshold since January 2022, from 3.7% a year earlier. The forecast is for the rate to be held there.

Under normal circumstances, an unemployment rate of 4% would be cause for celebration, not concern. However, what is catching the eye of some economists is where the rate now compares to where it was last year.

The May rate was 0.5 percentage point above the 12-month low of 3.5% in July 2023, potentially triggering a recession indicator called the Sahm Rule. The rule has consistently shown that whenever the three-month average unemployment rate eclipses its 12-month low by half a percentage point, the economy is in recession.

While there are few data signs that a recession is around the corner, the unemployment trend is drawing attention.

“If the unemployment rate does what it’s been doing lately here where it’s rising very slowly, I don’t think that means we’re at a very high risk of triggering a Sahm rule or some kind of unemployment rate-measure. based on going into recession,” Bunker said. “That said, the probability of that happening has increased, even if it’s not the most likely outcome right now.”

The economy has slowed in the first half of 2024. First-quarter growth as measured by gross domestic product rose at an annualized rate of 1.4%, while the Atlanta Federal Reserve is tracking just 1.5% growth in the second quarter.

There are also lingering concerns about inflation that could keep the Fed on the sidelines for longer in terms of lowering interest rates.

In addition to the headline payroll and unemployment numbers, market participants and economists will be watching several other key metrics.

Another area of concern has been the divergence between the number of nonfarm payrolls, as obtained from establishments participating in the Bureau of Labor Statistics survey, versus the number of households of people who report being employed.

While the establishment survey showed payrolls rose by about 2.8 million over the past 12 months, the number of households, which is used to calculate the unemployment rate, rose by just 376,000. Economists generally consider the business survey to be more reliable and less volatile since it includes a larger sample size, but the disparity has drawn attention.

Additionally, hours worked and average hourly earnings will attract attention as gauges of inflation.

The forecast is for a monthly wage gain of 0.3% and a 12-month growth of 3.9%. If the outlook holds, it will mark the first time annual growth has been below 4% since June 2021.

Post Comment